The Market is good value . . . but only some stocks are.

During the stock market carnage of the past few weeks I have focused more and more in trying to find value in large cap Eurozone equities. It is my belief that the present phase of markest is a cyclical bear leg of what has been a secular bear market. For a really great and simple analysis of the secular and cyclical bull and bear markets, then readers really should head on over to Crestmont Research. I remain convinced that we are in a secular bear market, and that like all such markets, it will not end until the valuation becomes so low that it presents what I call a generational opportunity to invest. If anyone is in any doubt that the key driver of forward equity returns is anything but valuation then they really should look at the following chart (also from Ed Esterling at Crestmont).

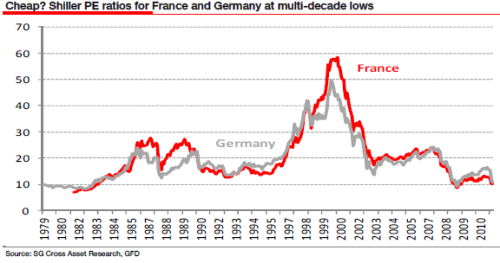

I have mentioned previously that I think the valuation opportunity in European equities (particularly Eurozone) equities is trending toward the extremely attractive levels that I am seeking. The chart below is reproduced from a piece recently by the ever interesting Soc Gen strategist, Dylan Grice. Mr Grice having been a long term bear, not unlike myself, is turing ever so slightly bullish.

The Schiller PE for MSCI Europe is 12x.

With this in mind, I went thru the mindnumbingly boring task of calculating the Graham and Dood PE for each index constituent of each large cap equity index within the Eurozone. (I probably need to get a life!!!!).

I was testing was how attractively valued individual large stocks were given the attractiveness of the index valuation. What I found is that in the vast majority of cases, it was only really Financials, Energy, Utilities and Contruction stocks that offered Graham and Dodd PE’s below 10x. What struck me was that a host of large cap energy related names such as Total SA, ENI, Repsol traded on a Price/avg 10yr EPS of less than 8x. Allied to this was that many large cap energy utilities (E.ON, RWE, ENEL, Endesa) also trade on single digit Graham and Dodd PE’s.

Stocks such as Total, ENI, E.On and Endesa have appeared numerous times across a host of stock screens such as P/B screens and Greenblat type screens. In addition, many of the stocks boast chunky dividends.

Given that I own a bank and a construction stock, I feel it is time that I get some energy!

Malthus was right!!!

I love to read Jeremy Grantham of GMO. As well as being a truly great investor, he certainly has a flair for writing about investing. During his Q1 and Q2 Newsletters, Grantham has analysed just how short the world is of basic resources at the present time. In Grantham’s eyes. the balance in terms of resorce scarcity has been tipped. There is a combination of dwinling resources allied to the fact that the largest countries on the planet (in terms of population), are growing the fastest. According to Grantham, this has not happened to such an extent previously. It is putting a strain on commodity prices that means that for the foreseeable future we are likely to live in a secular bull market for commodities.

Essesntially, Malthus was right, just about 200 years out on timing!!! Now I am no bull on China, in fact I see many reasons to be fearful of the Chinese investment story. Anyone that wants to find out more about why China is a bubble waiting to burst should check out Jim Chanos of Kynikos or Hugh Hendry of Eclectica. An overdue cyclical correction in China, will have repurcussions for the commodity complex.

Nontheless, I am seeing a situation in which some of the largest publicly traded companies in the basic resources space are trading at deep discounts to both the market and other resource stocks.

Total S.A.

In the case of Total SA, the French listed oil major, the stock trades at a Graham & Dodd PE of 7.6x and a P/B of 1.2x. This is a discount to the market in terms of earning but on a market book value multiple. This implies that at the present valuation I am buying the returns that are in excess of the markets ROE for a discount to the market.

To me this doesnt make sense, particularly, when Total SA earns its crust from exploring, extracting and refining a scarce resource, that is not likely to get less scarce. In Furthermore, large cap oil is trading at a sizable discount to large cap mining equities. Finally, inspite of the fact that capex has ramped up over the past three years, Total has generated FCF between €5 and €7bn each year.

Total has seen a significant derating throughout the past 5 years, now why could that be?

A simple way of analysing any firms performance is by a simple dupont analysis of Sales, margins and asset intensity. Despite living in what is a global commodity bull market, sales at Total SA have only grown at an average compound rate of 2.8% per annum over the past five years. During that time, the average annual price of a barrel of Brent Crude Oil fluctuated between $54.50 and $97.00. The European refinery margin, which is just as important for an integrated producer such as Total SA fluctuated between $2.02 and $5.66. Due to physical and financial trading and hedging activities it is difficult to say what impact strengthening or weakening prices will have on any one set of annual results. For example, Total’s gross profit of €49.3bn in 2008 was almost identical to the level achieved in 2007, despite oil prices and refinery margins that were well ahead of the 2007 levels.

In the past decade gross margins and operating margins at Total have been pretty volatile fluctuating between 9.9% in 2002 and 19.6% in 2006. Opertaing margins at the end of 2010 amounted to 13.4% and rebounded to 15.5% during the 1st half of ths year.

More interestingly Asset Turnover has decreased significantly in the past two year. Asset Turnover of 0.88 and 0.98 for 2009 and 2010 respectively are well below the 1.15-1.3x range over the preceding decade. This is an area that could well be symptomatic of a piece in that excellent Grantham article. That as the supply of resources is depleting, the asset base yields a lower return going forward. I am not certain that this is provable from the present case, but it is a case that conventional peak oil was reached some while back, and more of the worlds hydrocarbon supply is coming from high cost or what was unconventional oil supply (such as deep off shore drilling, tar sands etc).

Now whilst margins have fluctuated and asset turnover has fallen, Total has reduced the amount of leverage on its balance sheet reasonably significantly. Equity is now approximately 42% of total assets having been at 38% for much of the 2000’s. Despite all of these drags on returns, ROE has fallen from well in excess of 20% to 17.5%. At the same time ROA has declined from its average of almost 11% to 7.4% in 2010.

We are now left with a company that despite returns well ahead of the market, is barely trading on a market multiple in terms of book value. Unless margins are likely to erode significantly this seems to me to present a classic valuation opportunity.

At a cashflow level the company shows some real interesting trends. Free cashflow at almost €6billion in 2010 was almost identical to the level experienced in 2001. Any growth in operating cashflow has been eroded by a growth in capital expenditure such that capex is now running at in excess of 7% of the asset base. I am not sure as to how mean reverting this series is, but if it is then there is cashflow upside. Again, given that more unconventional oil is now being drilled it should not surprise that the capex line has expanded sigificantly.

All of this suggests to me that this company, despite the oil price, is not operating at levels of margins or efficiency that are in any way extended or at a cyclical peak. I have no real feel for where margins and returns are heading, but I am deeply enamoured by a stock with a real yield of 7% trading on single digit earnings and cashflow multiples that despite an increasing asset intensity and strengthening balance sheet still produces mid teens returns. I would rather in the medium term to own more assets like this and less of nominal assets with yields that do not reflect any risk of future inflation.

I have purchased a 5% position for my portfolio below €32.50. When comparing Total with ENI and Repsol, I discounted ENI very quickly, for a number of reasons. Chief among these was a substantially inferior free cashflow history than Total. This allied to a history of lower returns give me a preference for Total. ENI does however trade at a lower multiple than Total in terms of book value (0.85 vs 1.2x). Repsol was ignored due tio a combination of higher gearing, lower yieldand poor cashflow generation.

It also seems to my fairly simple technical mind, that on a very long term chart outlook, that there is some strong support levels betwwen €29-€32. The stock is oversold both on a weekly and monthly basis, and is back at 1999 levels.

This now leaves me with a portfolio invested in CRH, FBD (purchased in Nov 2010 for €5.80), Lloyds Banking Group and Total SA. So approximately 20% at present.

I will hope to go thru the FBD investment case at some stage in the near future.

Energy Utilities

Eurozone Electricity & Gas utilities have continually appeared in various valuation screens that I have run. In most cases they meet the desired criteria of having a low P/B valuation with a single digit Graham and Dood PE. In the past five years the sector has been far from defensive and has regularly been in the bottow quartile of returns. The problem with many utilities is aptly summarized up by the Lex column in the FT (20 Sept, 2011),

Nearly two decades of dergulation have created huge cross border, vertically integarted listed oligopolies. . . Now they look bloated, over-leveraged and vulnerable to unexpected events.

Having specialized in utility investing during my career as an investment manager, it is an area that I have always had reservations about. They are to my mind the antithesis in what an investor normally seeks in an equity, in that they are in many cases leveraged, deflationary and regulated. An ideal starting point, it is not.

Of the large cap continental European utilities, valuation does look favourable.

| Company | Mkt Cap | G&D PE | Book Value | P/B | Net Debt | Gearing | Int Cover |

| E.On | 30360 | 6.4 | 41653 | 0.73 | 18037 | 59.4% | 4.1 |

| RWE | 14000 | 6.2 | 14574 | 0.96 | 11556 | 82.5% | 7.7 |

| GDF Suez | 46310 | 11.6 | 62203 | 0.74 | 33663 | 72.7% | 5.5 |

| ENEL | 28680 | 5.8 | 37861 | 0.76 | 46562 | 162.4% | 4.2 |

| Iberdrola | 29080 | 12.4 | 29079 | 1.00 | 23828 | 81.9% | 3.9 |

| Endesa | 18030 | 7.1 | 17776 | 1.01 | 10569 | 58.6% | 7.5 |

From this list, I think Endesa looks appealing given its low valuation allied to a balance sheet that is clearly stronger than many of its peers. However ENEL, the Italian listed electricity utility owns 92% of Endesa. The minority rights of shareholders is questionable in many places, Europe in partivular. I most confess however that in this circumstances I do not know what rights a minority shareholder may have. What is of interest is that ENEL’s 92% of Endesa is worth 58% of the market capitalisation of ENEL.

So in my next post I will delve into both Endesa and ENEL (I must say, I can’t wait). The job of a value investor is so glamorous.

Out of pure curiosity I will take a peak at E.On, the troubled German utility also.

Good analysis John.

I also like Allianz the big German insurer. At €64,56 at a PE of 6,8 and DY of 7% (FT) and price to book of 0,65.

Balance sheet is also very conservative.

RWE and E.ON is really going through a hostile regulatory period in Germany with the closing of nuclear after the Japan disaster and the nuclear tax. I have not looked at the situation in depth as its all too uncertain for me at the moment with no clear political direction you can work with.

Thanks Tim.

I think that you hit the nail on the head when you mention political direction, in that oftentimes it is important in the future profitability of utilities.

Very interesting post. Are you not worried that even the 10y PE flatters energy stocks because the bull market in resources is over 10 years old – in other words 10 years is not long enough to capture a full cycle – including the previous decade(s) of low prices and, presumably, profits?

Like you I am fascinated by Grantham’s views on diminishing resources. But accepting them goes against the grain for a value investor because it means ‘this time is different’. so much of value investing is betting on reversion to the mean – things are bad, but they’ll get better – the normal cycles go on – but you’re betting on things not getting better…

Hi Richard.

I think that its a valid concern, but one that on closer inspection is not one that I am not worried about. During the decade in question the Brent front month traded from mid $20’s to over $100. In that time refinery margins have fluctated from $0.71 to $6.49. Each year in a G&D PE calculation is equally weighted for me, so I am studying years of very strong and very weak prices. Allied to this thru hedging and the fact that a sizable portion of exploration earnings come from ‘production sharing agreeements’ leads to a situation whereby there isnt necessarily a linear relationship between oil price strength and profitability in every year. The concerns that you raise are valid, but they are more valid for a pure play exploration stock I feel.

The integrateds have a lot of moving parts and are rarely unhedged from a refinery point of view especially.

I am speculating that the cashflow is sustainable, the dividend will be paid and the returns will continue.

Thanks for the comment.

John

Dear John,

I like your overview a lot. Some “continental” views on utilities:

– I think the smaller utilities are worth a closer look as well. For instance EVN (Austria) or Fortum (Finnland) are well managed companies with rock solid balance sheets. Fortum for instance is kind of a nuclear / Hydro Pure play with a Russian Option attached

– EON and RWE are badly managed, however their main problem is not the nuclear tax but bad natural gas contracts with Russia where they are loosing billions each year. For me they would be prime targets for acitivist investors, Especially EON, as RWE ist still dominated by state owned entities.

– in general, I refer utlties where the government has already enacted some extra levies on the utilities (Finnland Germany). Especially within the PIIGS, the likelhood for some kind of “robin Hood” Taxes is extremely high

– last but not least, if you are really into “deep value” you could look at something like Public Power (Greece).

memyselfandi007

@memyselfandi007

Thanks for the insight re gas contracts. I did recall there was an issue, but has been some time since I looked closely enough at Eon.

As for Public Power, I appears in so many value screens. – I would however stay well clear of any asset that is partially state owned ad controlled. Also in the past, Greek Govts have removed CEO’s as it suited their political aims.

Its not just Greece, in my humble opinion the linkages between many European states and large publicly quoted companies are way too close – particulalry in Germany and Italy. In the past I have preferred to invest in the UK, North America and Scandinavia for that very reason. However as of the moment, value is most evident in Eurozone equities.

John,

same for me, I wouldn’t touch Public Power. That’s why I am hesitating to buy any PIIGS utilities as well.

However most European utitilities are more or less government owned /influenced , including EVN and Fortum.

EON seems to be the exception, I am not aware of any major Government stake there,

memyselfandi007

John, I just stumbled onto this article:

Utilities Giving Away Power as Wind, Sun Flood European Grid

http://www.bloomberg.com/news/2011-09-29/utilities-giving-away-power-as-wind-sun-flood-european-grid.html

This is a huge problem that is only going to get worse for big utilities burning gas and coal, also in the UK with all the offshore wind parks being built.

I would be very careful of utilities going forward. The industry is changing fundamentally and they are not part of it.